A payment registration number (PRN) is mandatory in order to make all URA tax-related payments at the bank, mobile money, POS services like Pebuu, Payway, etc. In order to obtain a URA PRN, one has to visit the Uganda Revenue Authority web portal and register a payment.

The payment registration process at the end of it all allows one to obtain a unique payment registration number which is supposed to be presented at the bank, in a number form, or on a printed paper. The bank then clears the payment depending on the amount and names which the payment registration number shows.

Once the payment is successfully completed, the money is transferred to the URA bank account directly, and the payment registration number status will change to submitted and cleared. This status clearly indicates that the taxpayer has fully paid the amounts which were corresponding with the PRN, and the bank which cleared the payment is shown.

Examples of payments that require URA PRN

- Driving licence processing fees

- Motor vehicle transfer

- Motor vehicle alterations

- Duplicate number plates

- Imports and exports of goods

- Value-added taxes

- Stamp duty

- Passport processing

- Income tax

- Advance income tax for motor vehicle

- Local excess duty

- Withholding tax

- Gaming tax

- Government ministry and agency payments

- Birth certificate processing fees

- Passport processing fees

- Company registration fees

- And a lot of other e-Tax payments

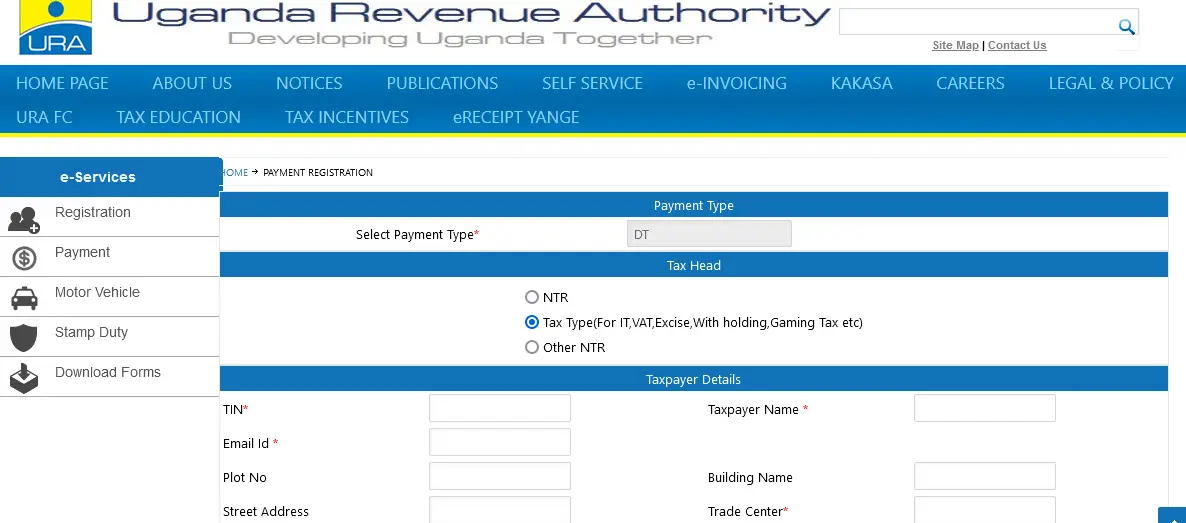

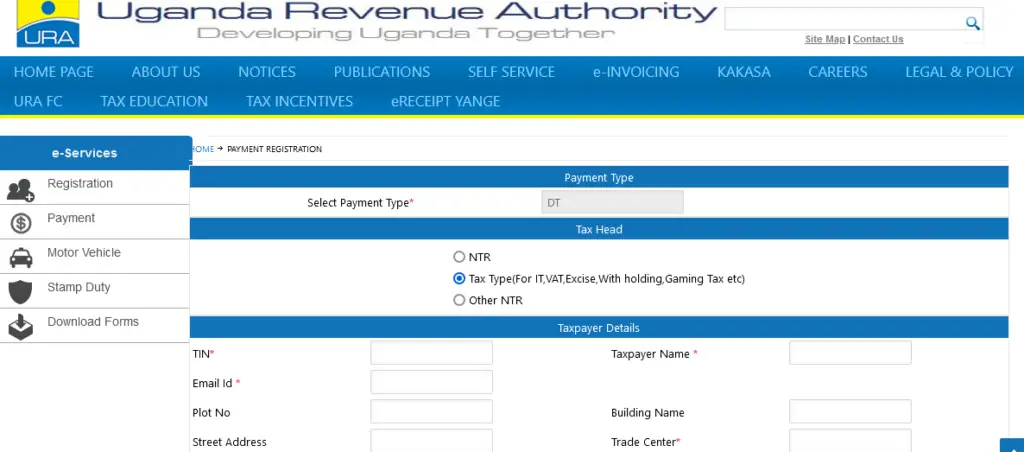

How to Register a Payment on URA Web Portal

- Visit “ura.go.ug” web portal

- Click on “eServices” from homepage

- Click on “Payment Registration” under the payments menu

- Select the “Tax Head” e.g NTR

- Enter “Taxpayer Details” e.g Full names, email, etc, or simply input TIN

- Select “NTR Head” under NTR details e.g Foreign Driving Licence Exchange 3 years

- Enter “Given Text” as shown in the box

- Click “Accept and Register” and click on to confirm submission

- Click “Print ” and print the generated forms.

- Your Payment is successfully registered and visible on the forms.

Important to note about URA PRN

- Always confirm that the names shown on the payment form are exactly what you indicated.

- If possible, add your email address for easy tracking from generation to payment.

- Always pay at the bank within 21 days from the date of PRN generation

- Always ask for a payment receipt from the bank or any other payment option used.

Proceed and make the payment at the bank

The printed forms will contain the generated URA Payment Registration number. You can proceed to the bank of choice as shown from the list of banks authorized to collect URA Payments and complete the payment. You will be issued with a receipt which is matching with the exact details on the payment registration form. The same is attached with the Application form for submission where necessary.

Discover more from Drivewithalicence.com

Subscribe to get the latest posts to your email.